By Dennis Baran

Objective and strategy

The managers seek long-term capital appreciation by investing in a concentrated portfolio of 30-40 mid and large capitalization companies over $2.0B that use sustainable business strategies (SBA) to drive future earnings growth.

They focus on finding companies whose sustainability strategies are generating tangible business results such as revenue growth, cost improvement, or enhanced franchise value. Such companies may enjoy competitive advantages from environmentally efficient design or manufacturing or offer products or services that address sustainability challenges.

Sustainable business advantage analysis complements thorough fundamental research and a strict valuation discipline. Only companies with strong fundamental, sustainable, and valuation characteristics are considered for investment.

Adviser

Brown Advisory, a private independent investment management firm founded in 1993 in Baltimore within Alex Brown & Sons. The firm employs 600 people in eight offices, manages 15 mutual funds, is a sub-adviser on four others, and runs 29 additional investment strategies. Total firm AUM as of September 30, 2018: $68.4B.

Managers

Ms. Funk, CFA joined Brown Advisory in 2009 from Winslow Management Company where she was a Portfolio Manager and Equity Research Analyst running an ESG- focused equity mutual fund. She has investment experience since 2003. Brown acquired Winslow in 2012. At a young age, she developed an environmental awareness that led to corporate, consulting, and engineering jobs, i.e., “applied sustainability,” and eventually into asset management with a vitae par excellence:

Ms. Funk, CFA joined Brown Advisory in 2009 from Winslow Management Company where she was a Portfolio Manager and Equity Research Analyst running an ESG- focused equity mutual fund. She has investment experience since 2003. Brown acquired Winslow in 2012. At a young age, she developed an environmental awareness that led to corporate, consulting, and engineering jobs, i.e., “applied sustainability,” and eventually into asset management with a vitae par excellence:

- S. Chemical Engineering Purdue University

- S. Civil and Environmental Engineering MIT

- Another M.S. Technology and Policy MIT

- Post-Graduate Diploma École Polytechnique France in Environmental Engineering

Mr. Powell joined Brown Advisory in 1999 as an equity research analyst with responsibility for identifying and recommending companies in the industrials, materials, and energy sectors, particularly those that helped them save on energy, water, and raw materials. Companies making money from using sustainability to power growth motivated his interest in managing an ESG strategy.

Prior to joining the firm, David held a position in investor relations at T. Rowe Price. He has investment experience since 1997.

A “right-sized number of analysts” support the PMs as members of the Sustainability Team.

Strategy capacity and closure

Total AUM in the strategy (mutual funds, a UCITS European mutual fund, and separate accounts) was approximately $1.8B as of September 30, 2018. The firm generally starts looking at capacity issues around $15B in their large cap funds before being concerned about their ability to manage portfolio liquidity.

Active share

The average for the past two quarters is 75%.

Active share measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. The fund’s active share reflects a high level of independence from the Russell 1000 Growth Index.

Management’s stake in the fund

As of June 30, 2017, Ms. Funk owns between $100,000-500,000 of the fund and Mr. Powell over $1,000,000. As of December 31, 2016, two of the six trustees has invested in the fund, one owns over $100,000 of the fund and another between $10,000-$50,000. We will update those estimates once we receive the latest Statement of Additional Information, which will be released in the near future.

Opening date

June 29, 2012 and an SMA from December 31, 2009. The PMs manage these products exclusively.

Minimum investment

BAFWX Institutional Shares $1,000,000; BIAWX Investor and BAWAX Advisor Shares $100

Expense ratio

Institutional 0.74%; Investor 0.89%; Advisor 1.14%

Comments

The environmental and business cases for incorporating ESG factors into your portfolio are unassailable. It is very clear that the behavior of corporations contributes directly, for good or ill, to the habitability of the planet. It’s equally clear that investing in sustainable enterprises does not harm your harms, and might well bolster them. Larry Fink, president of BlackRock, the world’s largest investment firm, argues that within five years “all investors will be using ESG (environmental, social, governance) metrics to determine the value of a company.” That’s perfectly rational. An October 2018 review of the research by the Boston Consulting Group concludes that “ESG-driven decisions implemented well go far beyond good marketing, and actually boost the bottom line because they are more sustainable than decisions made to boost stock price in the short term” (Business Insider, 11/1/2018). That aligns well with both the research done by the Brown Advisory managers and with their performance.

The way to make money on companies with great ESG characteristics is to invest first in fundamentally strong companies that will outperform over time. So they look at their return on equity, earnings variability, historical earnings per share growth plus other factors.

Once they identify these companies, they can begin looking more deeply into whether a company’s management team understands its long-term sustainability risks and opportunities and is investing in them materially.

They use the term “sustainable business advantage,” or SBA, to describe the characteristics in a company’s business strategy that can add shareholder value through sustainability. Companies with great fundamentals and the potential to propel those outcomes through SBA are the companies they want to own.

It’s this intersection of company performance and ESG focus that defines sustainable investing for these managers.

It’s not a process that results from doing screens.

No screening approach is very helpful for bottom-up investors. While their research team obtains ESG data from many sources, including directly from companies, they don’t take reported data and metrics at face value: They corroborate what companies say and independently evaluate what they do.

As for using corporate or third party ESG ratings in their work, the managers say to take them with a grain of salt.

Why?

Whether you’re looking at mutual fund rankings, credit ratings or ESG grades, they should not be viewed as an endpoint but as the start of a research journey that spurs subsequent questions and more digging for information.

No amount of raw ESG data can tell an investor whether a company is a sound fundamental investment. Primary research is the only way to make well-informed investment decisions consistently, e.g., sustainability data and reports, public filings, and management interviews.

The managers do not build portfolios based on ESG factors alone. They are not in a “feel-good-business.” ESG factors are their means to an end, not an end in itself.

In summary:

Information about a company’s sustainability strategies and practices can be used to improve fundamental investment decisions. While ESG research does not by itself ensure investment gains or losses, when combined with additional due diligence, it can inform better investment decisions.

Risk Management and Performance

The managers emphasize that the fund’s focus is on generating performance or alpha, i.e., market independent returns better than what can be explained by beta, i.e., market risk or systematic risk. Their conviction that investors can use ESG information to produce alpha comes from their experience in managing idiosyncratic risk, i.e., risk to a particular stock rather than to an entire investment portfolio.

Even so, as active managers focused on these ideas, they openly admit that even “well-defined, statistically valid, and perfectly clairvoyant ESG metrics” would not help much with their primary task of a deep examination into individual companies and finding the select few that are poised to produce exceptional long-term business results.

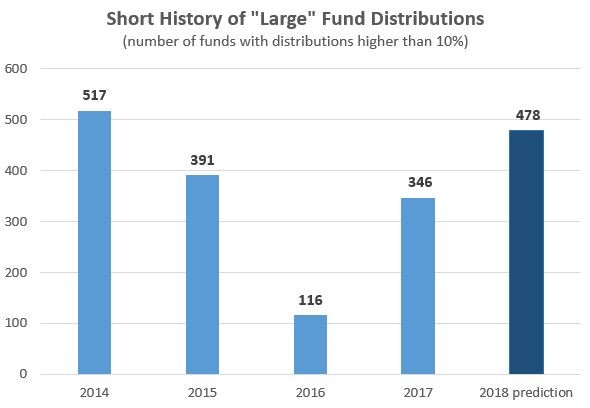

The fund does exceptionally well, against any plausible benchmark, over time. We first screened Lipper’s Socially Conscious (SC) category for U.S., global, and international multicap growth.

| |

BAWFX (Inst.) |

BIAWX (Inv.) |

| One year |

27.5%, 1st |

27.4%, 2nd |

| Three year |

19.8%, 2nd |

19.6%, 3rd |

| Five year |

16.1%, 1st |

16.0%, 2nd |

| Since inception |

18.0%, 2nd |

17.8%, 3rd |

Our second screen broadened the search to include all multicap growth funds, domestic, global or international, socially conscious or not. The results remain impressive.

Second, outside of the SC category, how do the funds’ APR compare to the most competitive subset of U.S., global, and international, multicap growth funds? We used the fund screener at MFO Premium to identify the multicap growth funds in the top 20% based on Least Drawdown; Best Sharpe, Sortino, and Martin Ratios; and Shortest Recovery.

| |

BAWFX (Inst.) |

BIAWX (Inv.) |

| One year |

27.5%, 7th |

27.4%, 8th |

| Three year |

19.8%, 3rd |

19.6%, 6th |

| Five year |

16.1%, 8th |

16.0%, 9th |

| Since inception |

18.0%, 5th |

17.8%, 6th |

Third, we looked at the fund’s performance relative to the S&P 500. It’s a flawed comparison because the investment styles are substantially different, but a relevant one because so many investors use the S&P as their implicit benchmark for any equity investment. Here’s the extent of outperformance of BAWFX against the S&P 500:

| |

BAWFX (Inst.) beat the S&P 500 by … |

| One year |

9.6% |

| Three year |

2.5% |

| Five year |

2.2% |

| Since inception |

2.7% |

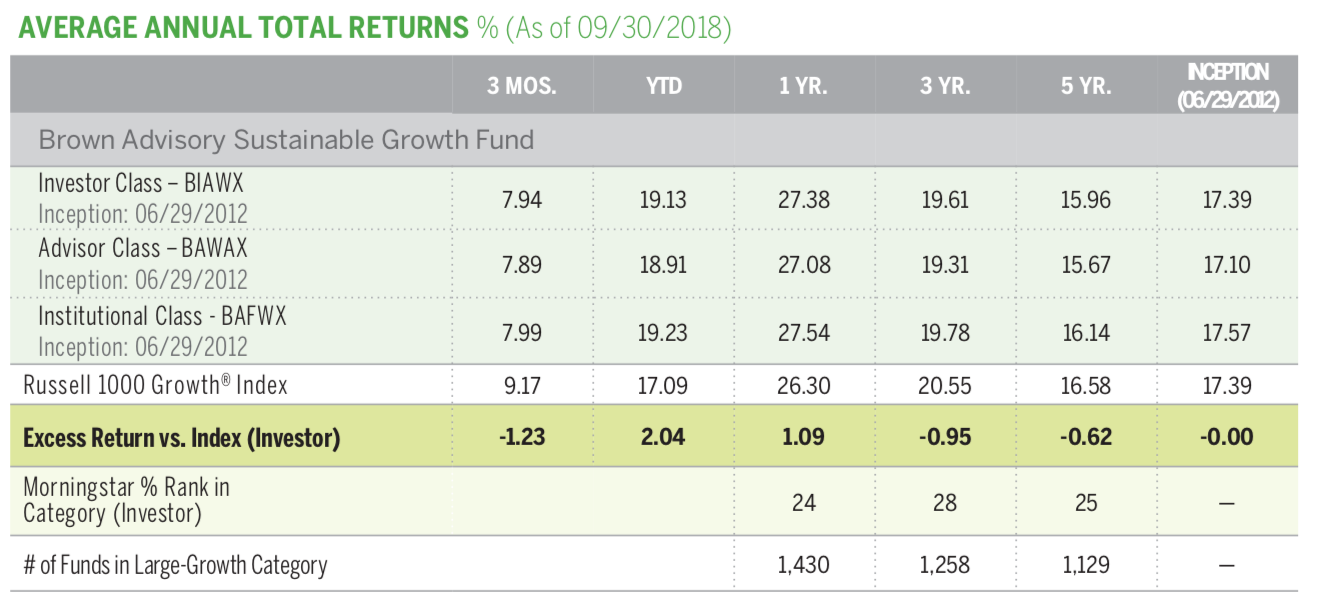

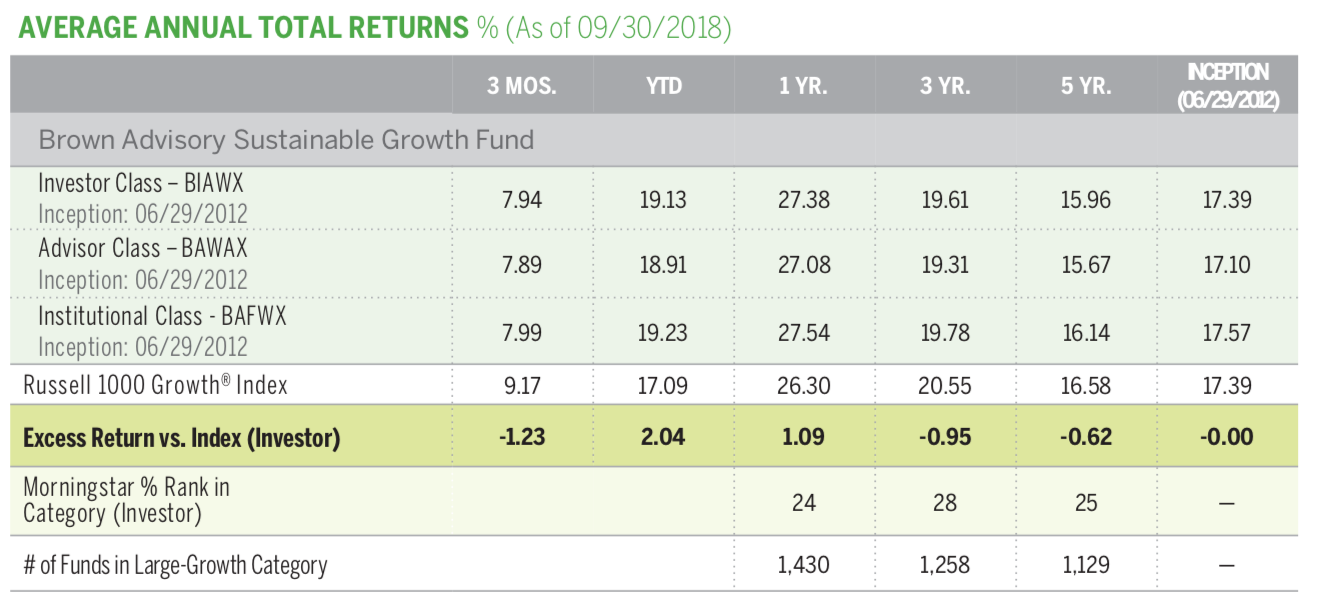

A fairer, but less common, comparison is with its Russell 1000 Growth Index benchmark. The fund has been consistently competitive against one of the hottest benchmarks since its inception.

The managers admit that they will underperform the market at times. The Russell 1000 Growth Index has been red hot for nine years at nearly an 18% compounded rate. The PMs looks for steady, not rapid growth. Now in the ninth year of a bull market, they are careful to avoid chasing momentum-led stories. That’s produced a nice asymmetry in which they capture most of their benchmark’s upside but much less of its downside.

Any time you capture more of an index’s upside than you capture of the downside, you’re producing a positive risk-return profile. For visual learners, we’ve marked all of BIAWX’s positive cells in blue.

| |

|

Since inception |

5 year |

3 year |

1 year |

| Russell 1000 Growth |

%age of the upside captured |

99.4 |

94.2 |

93.1 |

n/a |

| |

&age of the downside captured |

99.0 |

88.0 |

82.6 |

|

| S&P 500 |

%age of the upside captured |

104.0 |

103.0 |

108.0 |

121.0 |

| |

&age of the downside captured |

82.3 |

85.5 |

93.7 |

51.6 |

All data as of September 30, 2018

Yep. They’re all blue.

On September 30, 2018, its average portfolio turnover is 36.2%, annualized alpha is 0.29, and average beta is 1.0 since inception.

Bottom Line

-

The mangers make money.

Their fund returns in the Lipper Multicap Growth U.S., Global, and International Category; the Russell 1000 Growth Index; and the S&P 500 Index show that the team has outperformed the market whether in the ESG category or not.

With an 18.0% lifetime APR, BAFWX is an MFO Great Owl in the multicap growth category. That means it has consistently received a return rank of 5 (Best) for all periods three years and longer. It joins only nine other GO funds in that category.

BIAWX, with a 17.8% lifetime return, has also been a top performer.

Investors have not sacrificed returns or experienced a tradeoff from using ESG characteristics in the portfolio.

-

The managers are smart, careful, and even cynical. Just because a company issues a sustainability report, doesn’t mean that it’s added value. They’re only interested in companies that make an ESG impact.

Their legacy and reputation is based on repeatedly finding companies that hinge on sustainable growth drivers well before the rest of the market catches up.

-

The managers’ strategy is different.

They don’t use ESG to find companies that they believe are less harmful than others.

They don’t invest passively though a best-in-class approach aiming to find the best “scorers” in each industry trying to match the risks and returns of the broad market and therefore unlikely to outperform their benchmark.

-

The managers like David Snowball’s August 2018 MFO ESG article. They said,

“We strongly believe that the two important elements besides positive ESG profiles that can drive performance are good investments and good investors.”

They then added two paragraphs explaining their approach.

So if the question is, “Can investment managers who incorporate ESG attributes in their strategies deliver better performance?”

The answer: A loud clarion call of “Yes.”

Sustainability is not an obstacle to making money. Investors can have it both ways:

They can earn a profit and help the planet — as has the fund — while ESG continues to move consistently to the center of corporate thinking on strategy, risk, reputation, operations, efficiency, and long-term performance.

Fund Website

BAFWX/BIAWX

Karina Funk Sustainability TED Talk

Paul Volcker, in a recent interview in the New York Times on October 23, 2018, indicated that he thought the problem was that we have developed a plutocracy, consisting of an enormous number of very rich people who think they got that way by being smart and constructive. Volcker’s issue is that he thinks the educational system has been perverted by money (somewhat like Congress has become perverted by the permanent campaign, where dialing for dollars is ongoing). Rather than the schools teaching about governing, the elite universities focus on policy. Volcker fumes that “when you go to a school of public policy, you’re not learning how to run the goddamn government. You’re learning how to debate political issues.” And the idea, which Volcker supports, that we need stronger regulators in anticipation of the next crisis (and make no mistake, there will be a next crisis) is not high on anyone’s list of most needed issues to be addressed by Congress.

Paul Volcker, in a recent interview in the New York Times on October 23, 2018, indicated that he thought the problem was that we have developed a plutocracy, consisting of an enormous number of very rich people who think they got that way by being smart and constructive. Volcker’s issue is that he thinks the educational system has been perverted by money (somewhat like Congress has become perverted by the permanent campaign, where dialing for dollars is ongoing). Rather than the schools teaching about governing, the elite universities focus on policy. Volcker fumes that “when you go to a school of public policy, you’re not learning how to run the goddamn government. You’re learning how to debate political issues.” And the idea, which Volcker supports, that we need stronger regulators in anticipation of the next crisis (and make no mistake, there will be a next crisis) is not high on anyone’s list of most needed issues to be addressed by Congress. I felt badly that Mr. Market had somehow lost so much and checked dutifully under the couch cushions just in case it had dropped out of his pockets when he was over for dinner and Parcheesi Thursday night. No such luck.

I felt badly that Mr. Market had somehow lost so much and checked dutifully under the couch cushions just in case it had dropped out of his pockets when he was over for dinner and Parcheesi Thursday night. No such luck.

Ms. Funk, CFA joined Brown Advisory in 2009 from Winslow Management Company where she was a Portfolio Manager and Equity Research Analyst running an ESG- focused equity mutual fund. She has investment experience since 2003. Brown acquired Winslow in 2012. At a young age, she developed an environmental awareness that led to corporate, consulting, and engineering jobs, i.e., “applied sustainability,” and eventually into asset management with a vitae par excellence:

Ms. Funk, CFA joined Brown Advisory in 2009 from Winslow Management Company where she was a Portfolio Manager and Equity Research Analyst running an ESG- focused equity mutual fund. She has investment experience since 2003. Brown acquired Winslow in 2012. At a young age, she developed an environmental awareness that led to corporate, consulting, and engineering jobs, i.e., “applied sustainability,” and eventually into asset management with a vitae par excellence:

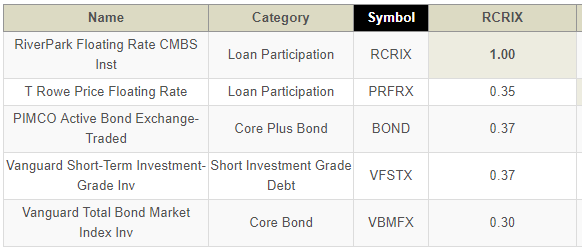

RiverPark believes that the Fund provides a unique opportunity to generate mid-single digit income yields (based upon current coupons and purchase discounts) with both limited credit and interest rate risk. Based on Libor today the Fund is generating a current coupon of 3.6%, and RiverPark believes based on where one year Libor is trading the coupon should increase to 4.3% over the next year. Investors concerned with the projections that the U.S. bond market is positioned to post real returns of essential zero between now and 2025 (GMO, 9/2018), it might be prudent to look for alternate sources of income. This likely belongs on your shortlist for such investigations.

RiverPark believes that the Fund provides a unique opportunity to generate mid-single digit income yields (based upon current coupons and purchase discounts) with both limited credit and interest rate risk. Based on Libor today the Fund is generating a current coupon of 3.6%, and RiverPark believes based on where one year Libor is trading the coupon should increase to 4.3% over the next year. Investors concerned with the projections that the U.S. bond market is positioned to post real returns of essential zero between now and 2025 (GMO, 9/2018), it might be prudent to look for alternate sources of income. This likely belongs on your shortlist for such investigations.